Portfolio

Portfolio Status as of May 2022

The club was anticipating a strong economy with the COVID pandemics end. However, the affects of continued supply chain problems, higher than expected inflation, and the Russian invasion into Ukraine have weighed heavily on the market.

Many of the club’s holdings have been made in assets with either lower variance or large market capitalization. The goal was to provide a steady income stream in quality assets. The overall market has gyrated over first part of 2022, and these assets have responded accordingly. Tracking the S&P 500, the SPY ETF is off 4.1% since the start of the year. The club’s usually reliable asset percentage gains/losses are shown here:

Percentage Gains | Losses

Asset |

YTD % Gain/Loss |

|---|---|

Alphabet (Google) |

-9.78% |

Intel |

-6.93% |

Coca-Cola |

10.72% |

Marriot Int’l |

14.25% |

McDonalds |

-4.19% |

3M |

-15.50% |

Microsoft |

-14.99% |

Oracle |

-8.77% |

AT&T |

8.50% |

Visa |

-0.30% |

Walmart |

9.38% |

Waste Management |

-0.63% |

The club’s technology stocks are clearly more volatile and have suffered due to prior overpricing due the pandemic. Happily, the non-tech stocks faired somewhat better and are keeping the club’s portfolio in the black.

One of the goals this semester was to put our excess cash to work. At each meeting the club officers present stocks to consider and often vote to make purchases on or after that meeting. The cash position has been halved as the club has sought opportunities for growth. Not all investments have led to gains, but it is believed each has strong potential in their respective sectors, mainly due to innovation and positioning.

One area of concern has been the investments in Chinese tech companies; Alibaba, Tencent, and Baidu. While all are dominant in their home company, the Chinese government has directly limited their opportunities, attributable to political concerns. This has been an extremely valuable lesson of club members about the potential, and concerns, of making foreign investments. The club sold off its holdings in Tencent music streaming but continues to hold Alibaba and Baidu. It is believed/hoped the political restrictions will ease and allow these companies to grow towards their potential.

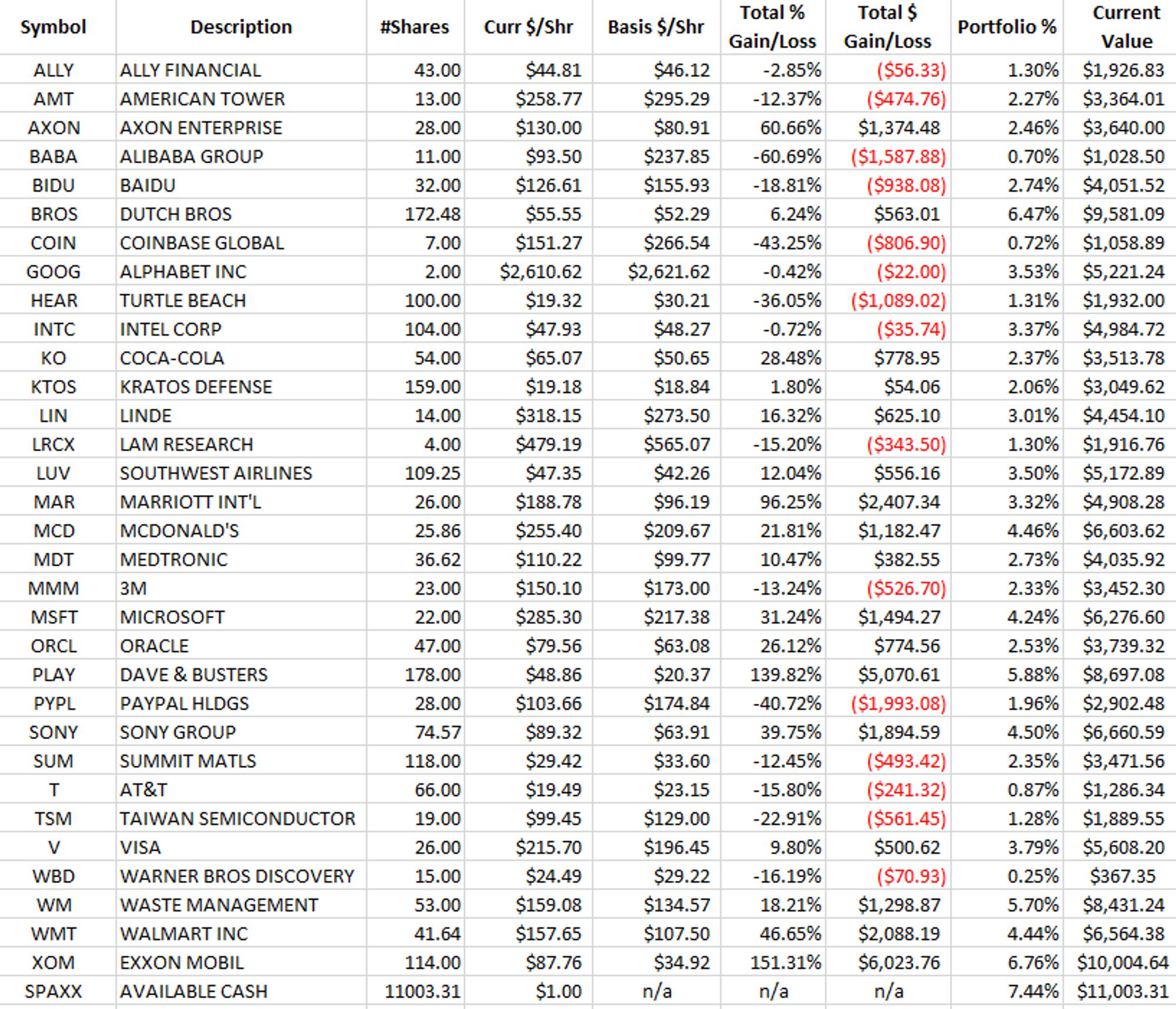

Below is a list of the Club position as of Apr 20, 2022.

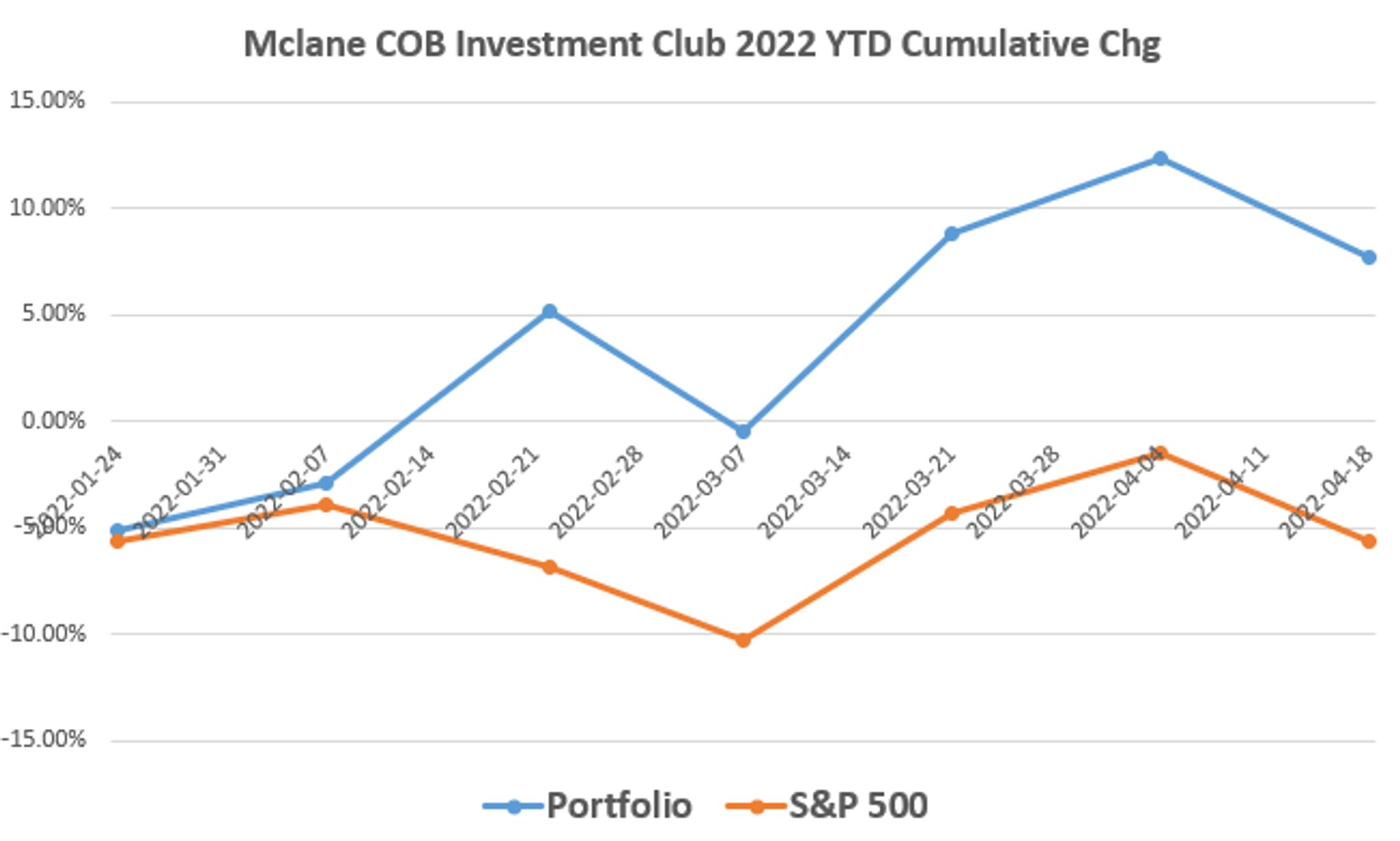

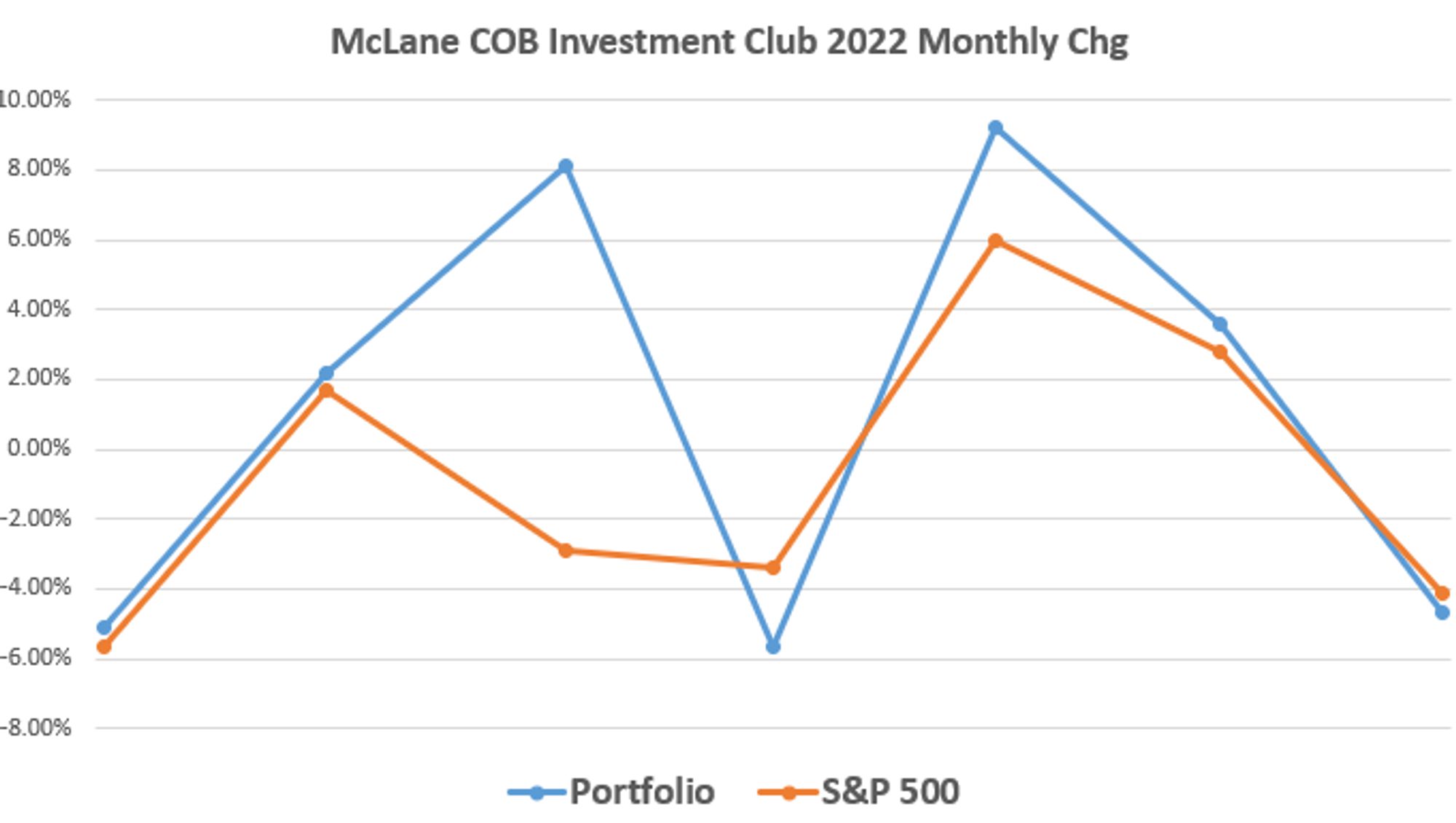

The Club has used the S&P 500 as our tracking index, with the goal to outperform each month. Overall, the Club has done well, staying well above the Year-to-Date returns of the S&P.

Portfolio holdings in Exxon and Walmart has helped keep the clubs YTD value positive. Due to the rise in political tensions, the club has considered stocks in the defense sector, recently purchasing Kratos Defense and Security (KTOS), a maker of autonomous drones, primarily for military applications. Other defense related stocks are also under consideration

Ongoing Challenges

Investment Strategy.

As stated above, our strategy has been to outperform the S&P 500 on a monthly basis; we have achieved this goal more times than not. The club believes its portfolio is well suited to beat the market average but achieving a return above inflation will be difficult.

Looking Forward.

Market shocks due to the potential widening of the Ukraine war, continued supply chain disruptions, and the actions the U.S. Federal Reserve to constrain the money supply coincide to make a challenging investment environment. Given these unfold as generally expected, the club will weather this storm. If continued unexpected shocks present themselves, more radical moves will be needed to reduce risk exposure and invest in value-assets.

Contact Information

Randi Fishbeck • Secretary to the Dean

rfishbeck@umhb.edu • (254) 295-4644

900 College Street, Box 8018 • Belton, TX 76513

Page last updated October 10, 2023